|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

Unlock your financial freedom with Credit Repair Baytown Texas-where we don't just fix credit, we transform your life; our seasoned experts are committed to elevating your credit score, empowering you to seize every opportunity, whether it's a dream home or a new car, because you deserve nothing less than the best; take the first step towards a brighter future today and experience the unrivaled dedication of a team that’s as relentless about your success as you are.

https://www.yelp.com/search?find_desc=Credit+Repair&find_loc=Baytown%2C+TX

Top 10 Best Credit Repair in Baytown, TX - February 2025 - Yelp - Credit Glory Credit Repair, ASAP Credit Repair, Independent For Life Financial Services, ...

Top 10 Best Credit Repair in Baytown, TX - February 2025 - Yelp - Credit Glory Credit Repair, ASAP Credit Repair, Independent For Life Financial Services, ...

https://sites.google.com/view/baytowncreditscorerestorations

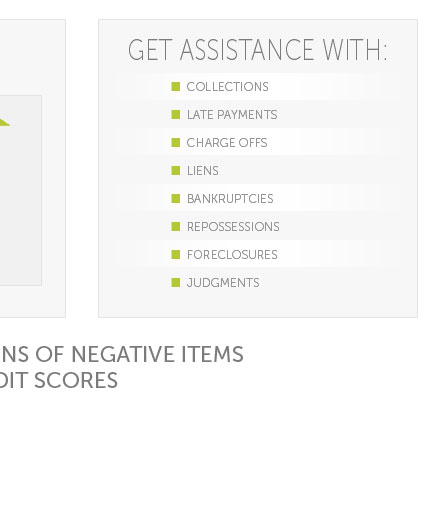

We can help you fix that. We are a baytown, Texas-based credit repair company that assists customers in getting the homes, loans, and financing they want. We ...

We can help you fix that. We are a baytown, Texas-based credit repair company that assists customers in getting the homes, loans, and financing they want. We ...

https://asapcreditrepairusa.com/baytown

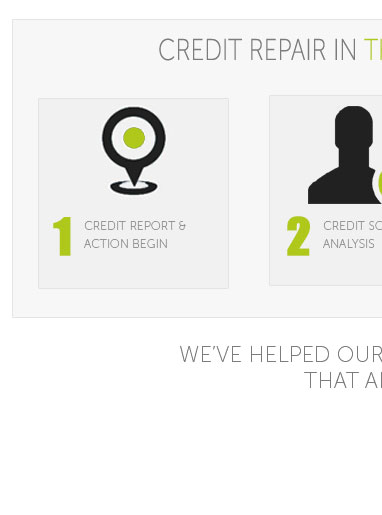

Established in 2008, ASAP Credit Repair Baytown is a family-run business specializing in credit repair. A hub for educating Americans about financial and credit ...

Established in 2008, ASAP Credit Repair Baytown is a family-run business specializing in credit repair. A hub for educating Americans about financial and credit ...